Financial Planning for an Aging Workforce

From early childhood, I remember relatives and friends of my grandparents complaining about their daily grind and waxing philosophical about the day they would turn 65 years old so they could retire and move out of the chaos of Los Angeles to somewhere like Florida or Palm Springs. In those days, very few Americans worked past their 65th birthday. But times and economic ideals change.

From early childhood, I remember relatives and friends of my grandparents complaining about their daily grind and waxing philosophical about the day they would turn 65 years old so they could retire and move out of the chaos of Los Angeles to somewhere like Florida or Palm Springs. In those days, very few Americans worked past their 65th birthday. But times and economic ideals change.

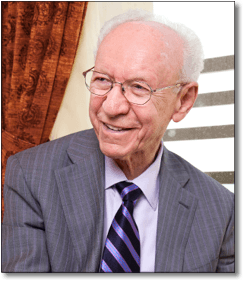

Americans are living longer and working longer than ever before. Aside from Petersen International’s own celebrated octogenarian, W. Harold Petersen, millions of “baby boomers” are continuing to hold employment well into their sixties and seventies. Many fear retirement as they ponder their own savings accumulation. Most have failed to sufficiently save for retirement and cannot rely on social security or other government-sponsored benefits to provide for them or their spouses as they age.

Persons of older age need income protection as much as their younger counterparts. And as a workforce nears the matured-end of the spectrum, disability insurance becomes imperative.

The disability market does seem to be taking these circumstances into account and giving it their “best shot”, liberalizing participation limits and age restrictions like never before. Traditional DI carriers are now frequently providing monthly disability benefits to age 67 and some to age 70. Several companies are also issuing new income protection policies to men and women over the age of 60. These are great strides the industry has made to keep up with the times and the demand. But it is not enough.

The companies offering benefits to near-retirement clients are still not willing to “jump-in” to the deep end of the risk pool. Their participation limits and benefit levels are still too timid for income earners of any age or of any income level. They also maintain strict occupation class restrictions on aged clientele, especially those with any sort of health issue.

The best solution in the approach to sound financial planning for persons nearing retirement is the disability income platform offered by the “alternate” DI market. Petersen International has the unique ability to offer comprehensive long and short term “own occupation” disability benefits to your clients in their sixties and even seventies. Our plans are also flexible enough to cater to those with minor to serious health concerns.

For the aging workforce of the U.S., financial planning can go hand in hand with retirement planning. Prudent advisors will coach their clients into sufficient income protection no matter where they fall on the age spectrum. “Baby boomers” need income protection as much as “millennials” do, and the proper insurance vehicles are available through Petersen International.